Robo-Advisors and Digital Transformation in the Financial Industry

Almost no industry is immune to the dizzying advances that software and technology are bringing us almost daily. Disruption is rampant, and digital transformation is the answer. This is the notion that traditional companies with traditional products and services, and traditional marketing, manufacturing, and distribution mechanisms must not only turn to software to compete in the new world, but must effectively become software companies. This is a tall order. Most modern large enterprises have experience making software, and in many cases, their experiences have been mixed at best. This is not to say that there aren’t highly competent technologists and non-software companies. There most certainly are. But changing the culture of an established and successful company to become a not just a hospitable environment for state-of-the-art software creation, but to maintain that as a permanent core competency is much harder than it looks. For years, many industries looked at the music industry’s apparent demise thinking that it would never happen to them. But it’s happening. And it’s happening fast. One of the latest industries to experience this challenge is the financial services industry.

Companies like Fidelity, Charles Schwab, eTrade, and Vanguard, are facing tech-oriented upstarts like Wealthfront, Betterment, Future Advisor, and Personal Capital. It’s almost hard to believe given that eTrade was once an upstart itself. Vanguard in some ways is the most interesting of the old guard as they’ve positioned themselves as the down-to-earth, no b.s. financial services company. That’s interesting because it’s effectively the very same positioning employed by the new breed like Wealthfront and Betterment. They’ve cleverly targeted the overhead of human financial advisors in the big companies claiming that by replacing them with algorithms they can save consumers enormously on fees. It’s the rise of the ‘Robo-advisor.’ And while we won’t debate the merits of that tack in this post, as a positioning, it works. Consumers are seeing technology replace all kinds of “middle men” in systems they’ve been using for decades — travel agents, taxi dispatchers, hoteliers, and even video store clerks (if you remember those). Financial services customers are inclined to believe that the large fees they’re paying might be a waste of money if human involvement can be lessened via smart technology.

The battle between these two groups is playing out in the press. Wealthfront CEO Adam Nash said this: “Charles Schwab initially set out to be different than Merrill Lynch. But today, Charles Schwab has become Merrill Lynch. And despite being 3,000 miles away, Wall Street has seeped into every fiber of the company.” Schwab responded: “Wealthfront CEO Adam Nash posted a blog that may have reflected his personal tagline, “inevitably optimistic, slightly amusing, always talking,” but it was very misleading.”

Here at Jackson Fish Market, Jenny and I have spent decades helping companies deliver design-driven software solutions to customers with thoughtful, practical approaches not just to software design, but to software development. We’ve helped build brands, build technologies, and build development teams. And the thing we’re most excited about going forward is spreading the gospel of thoughtful digital transformation to the industries that are in the middle of that very process.

At first blush companies like Wealthfront and Betterment present a compelling narrative that complements Vanguard’s decades long crusade on behalf of investors. Replace high-priced advisors with software. But while software has a role to play in automating certain portfolio caretaking functions, combining state-of-the-art software with an advisor can be an even more powerful solution. Even more importantly, these technology companies are not only devaluing the role of the human being in the process, they are charging a new layer of fees on top of existing costs for the privilege of doing so. And which funds do they primarily recommend? Vanguard’s own. Why would Vanguard cede the user experience to some Silicon Valley folks who happen to be software-first? These startups are camped out in Vanguard’s yard trying to disintermediate Vanguard’s customers and add cost, which is at odds with Vanguard’s ruthless and industry leading focus on reducing investor costs.

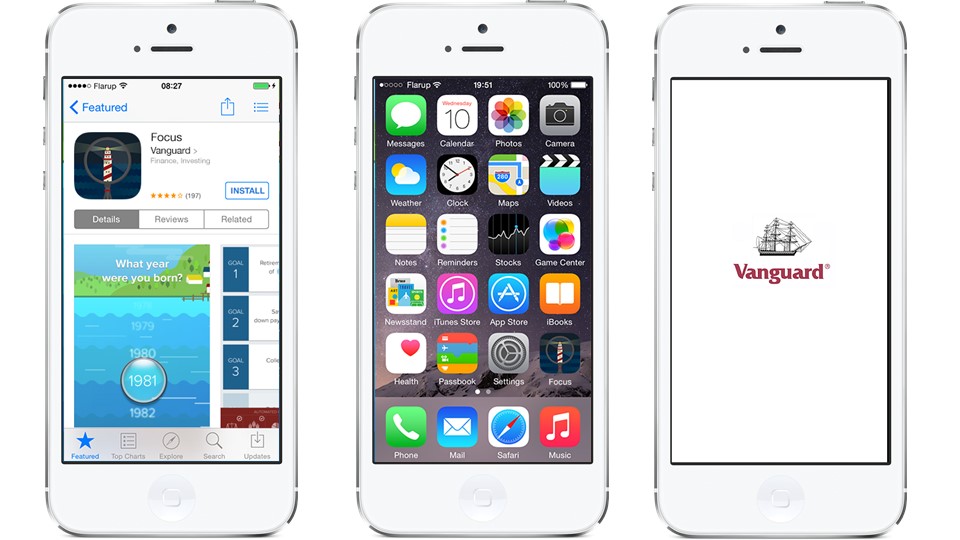

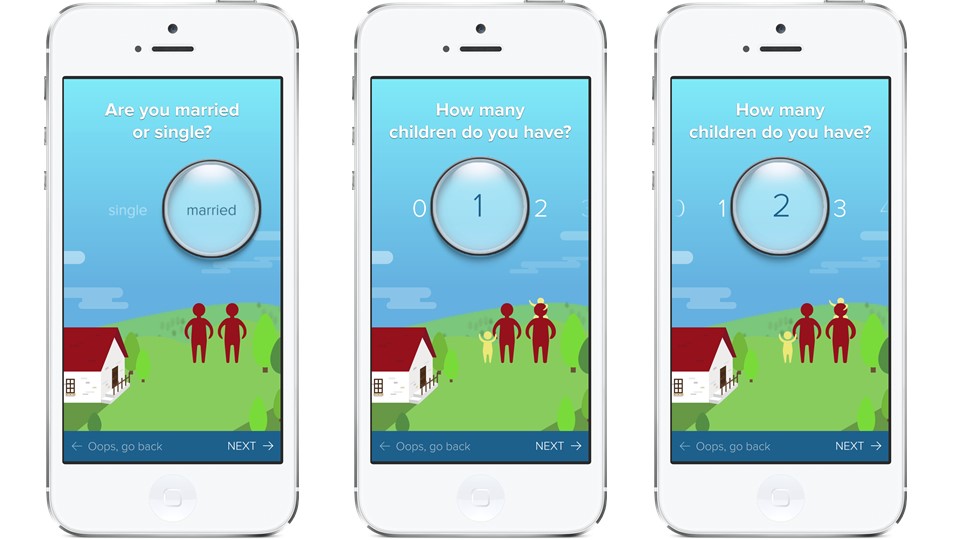

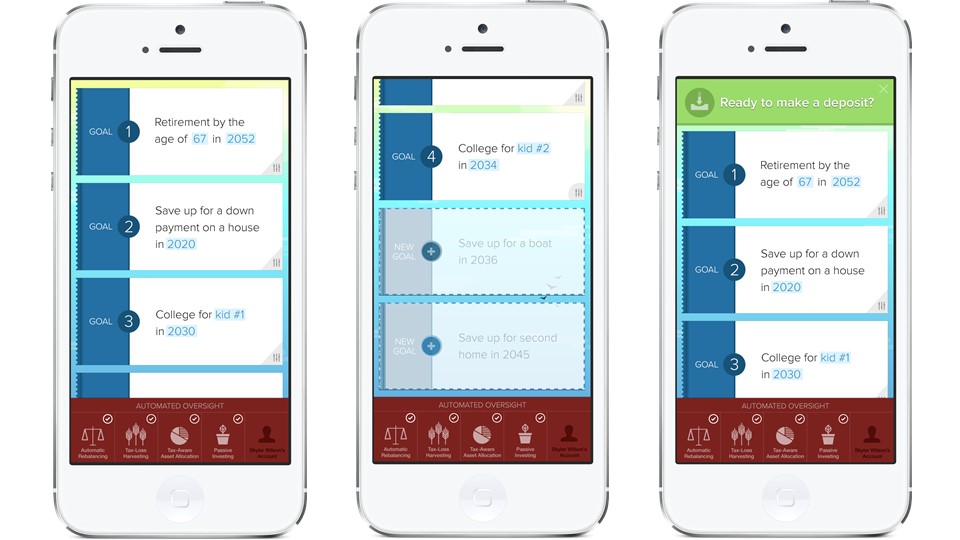

With zero permission from the good folks at Vanguard, we did a thought exercise on what a Vanguard Focus app might look like that appealed to millenials who are ready to invest, but are looking at some of the upstarts as a better fit than some of the more traditional investment houses. We asked ourselves the following question: For a new generation of investors, how do we compellingly integrate the best of automated-software portfolio management with Vanguard’s traditional, trusted, and proven customer-focused investment practices. The outcome of that is an incredibly simple app that reinforces Vanguard’s branding, combines the best of automated techniques from some of Vanguard’s competitors, as well as Vanguard’s famed human advisors into one package optimized for smartphones – the computing device of choice for the new generation of investors. We’ve included some screen shots of what that experience might look like below.

What do you think? Do the established players in the financial industry have anything to fear from the next generation? Does the old guard have unique value to add? Can the traditional players adapt fast enough and make software a permanent core competency of their organizations? We’d love to hear your thoughts.

“Robot Overlords” concept art by Paul Catling.